Bank investors often measure the franchise value of a bank by looking at the quality of the deposit franchise. Deposits are so difficult to raise that they provide the best point of differentiation among banks. After all, the asset side of a bank’s balance sheet is more commodity-like. Banks often make large corporate or real estate loans after the borrowers have shopped the loan to several banks. Consumer lending has consolidated to the large consumer-focused banks. Loans tend to be more transactional. But deposits are more relationship based, are harder to gather, and tend to be stickier part of the bank’s balance sheet.

When looking at deposits, bank investors look at deposit costs and product types. Non-interest checking balances have the most value. At the opposite end of the spectrum are brokered deposits, which may have negative value. The spectrum of bank deposits compared to value may look like this (ranked by most valuable to least valuable):

1.) Non-interest bearing checking

2.) Interest checking

3.) Savings

4.) Money-market accounts

5.) Retail CDs

6.) Government Deposits

7.) Jumbo CDs

8.) Brokered Deposits

With the introduction of ING Orange savings accounts 15 years ago, direct banking over the Internet created a new type of deposit account and a new type of depositor. The initial attraction of these online savings accounts was high rates paid on the deposits. These online savings accounts paid rates more comparable to money market mutual funds. Bank investors thought these deposits only existed due to the high rates paid, so they equated these deposits in the direct banks as the equivalent of brokered deposits.

The conventional wisdom that direct banks’ deposit franchises have little value may be wrong. They may be less valuable than a classic regional business banking franchise, but they seem to be providing more stable funding than capital markets or wholesale funding. Customers of direct banks have gotten into habits that make them sticky. They like the ease of use of the direct bank platforms. They like the rebated ATM fees, free wires, or better mobile apps. Some of these customers have developed emotional connections with their direct banks.

In Ally Financial’s November 2017 presentation to the BancAnalysts of Boston conference, the management presented several interesting slides that should cause bank investors to rethink whether they place a low value on direct bank deposits.

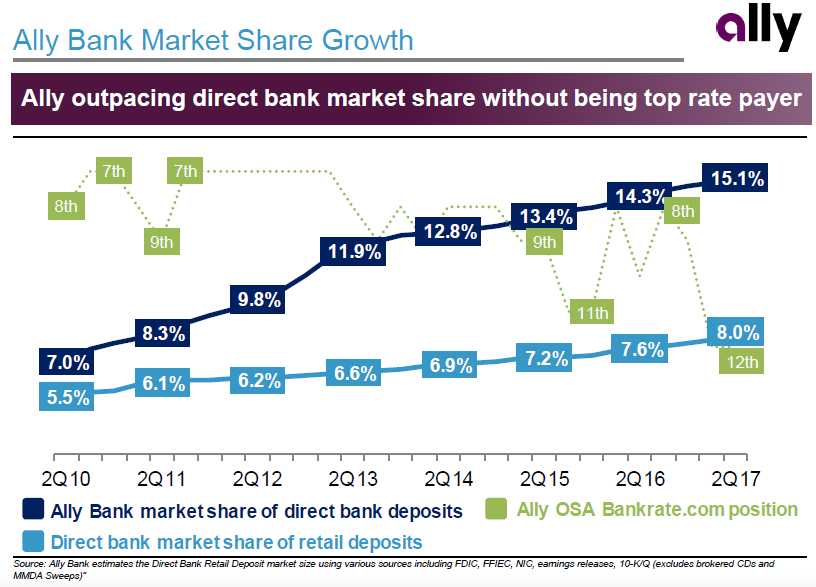

This slide is shown to provide evidence that Ally’s deposits are not dependent on paying the top rate.

Ally has doubled its market share among direct banks, but it has steadily moved down the ranking among top deposit payers. However, there are a couple of other things we observe from this slide. Direct banks are consistently gaining deposit market share. We can also calculate that Ally has tripled its national deposit market share in seven years.

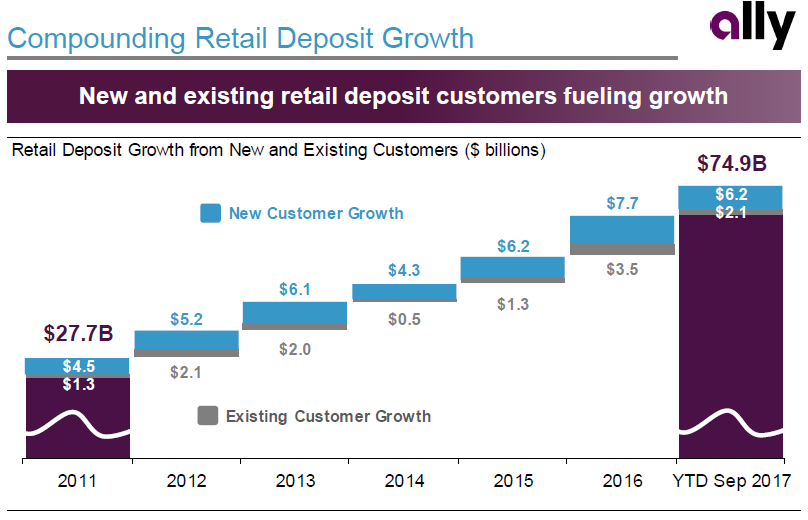

This slide shows that Ally’s deposit growth comes mostly from new customer deposits, but Ally also gets growth from its existing customers.

The growth of existing customer balances is important when thinking about the lifetime value of a customer because it seems that growth from remaining customers offsets attrition from lost customers.

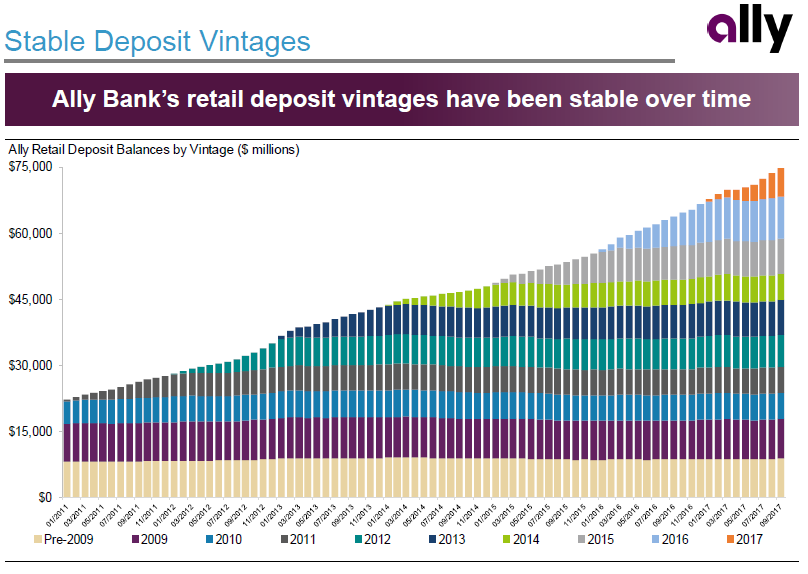

This slide shows the stability of each vintage of customer deposits. The stability of balances from each vintage of customers is remarkable.

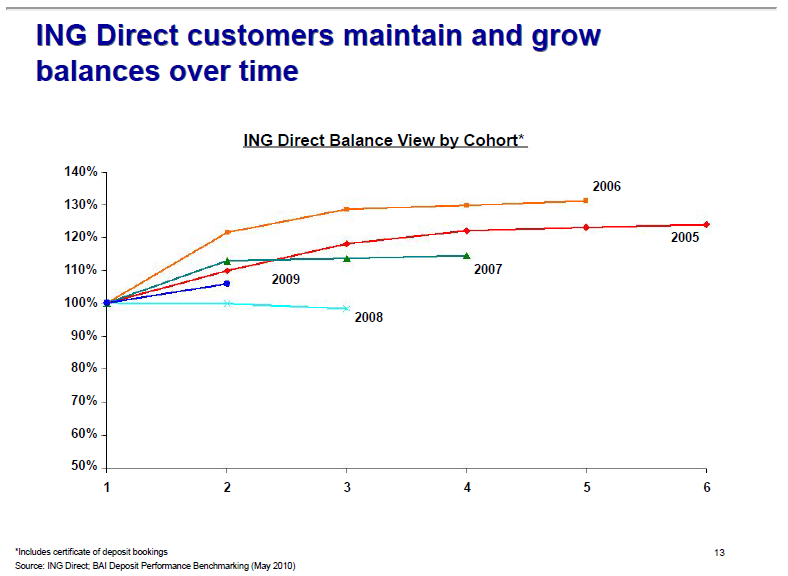

This slide reminds me of a similar slide that Capital One provided in its June 2011 announcement of its acquisition of ING Direct. Capital One shows that ING Direct’s customer balances were stable to even positive years after the customer opened the account.

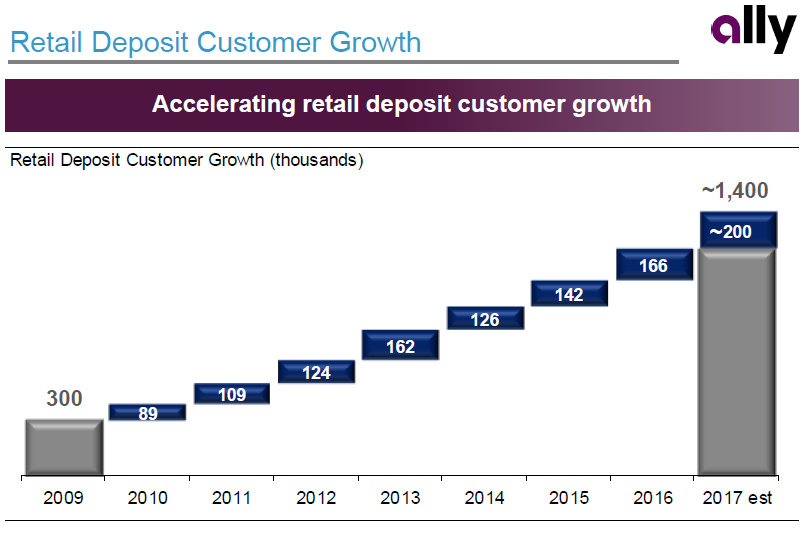

This slide shows the number of new customers that Ally has gained each year.

We can see that the number of new customers is accelerating in recent years. Since we know that Ally has $88 billion of retail deposits and they show us that they have 1.4 million customers, it looks like the average customer deposit account is $60k. The next time I talk with IR, I’ll have to ask what the median retail deposit customer account is.

Earlier, I referred to Capital One’s 2011 acquisition of ING Direct. At the time, ING Direct was the largest direct bank in the US with $77 billion of deposits. ING was forced to divest of their U.S.-based operations as a condition of their bailout by the Dutch government in 2008. At the time, ING Direct had $77.7 billion of deposits. Capital One paid a low premium for ING Direct of 122% of book value or 2.15% deposit premium, which reflected what a low value the market placed on direct banking deposits.

In addition to the customer vintage slide shown earlier, there are a few other slides from the Capital One presentation that I think are worth reviewing when thinking about whether direct banks have franchise value.

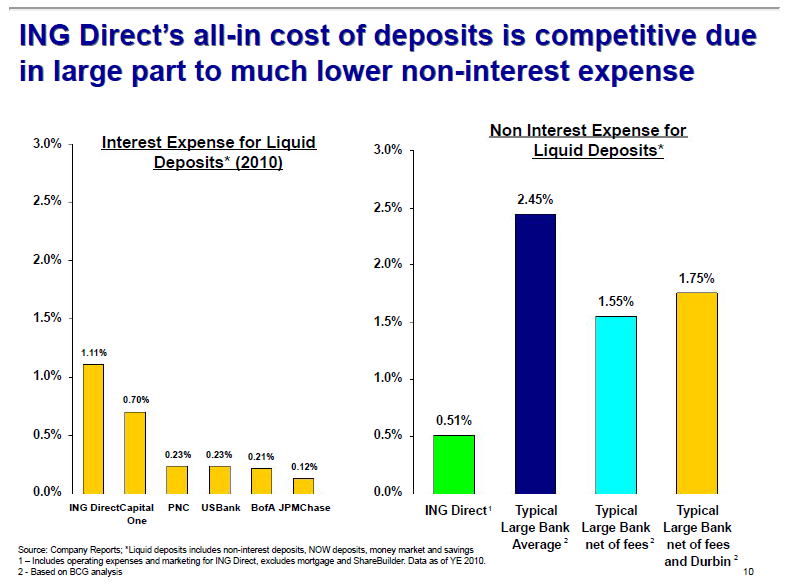

This slide shows how ING Direct’s all-in cost of deposits in 2010 was lower than other bank franchises due to the costs of running a branch system.

Capital One estimated ING Direct’s cost of deposits at 1.11% and non-interest expenses at 0.51% for an all-in cost of deposits of 1.62%. They compared this to several major banks, but looking at Bank of America for simplicity, they estimated B of A’s cost of deposits at 0.21% and their non-interest expenses for a typical large bank at 1.75% adjusting for fees earned and lower debit card interchange due to the Durbin Amendment for an all-in cost of 1.96%.

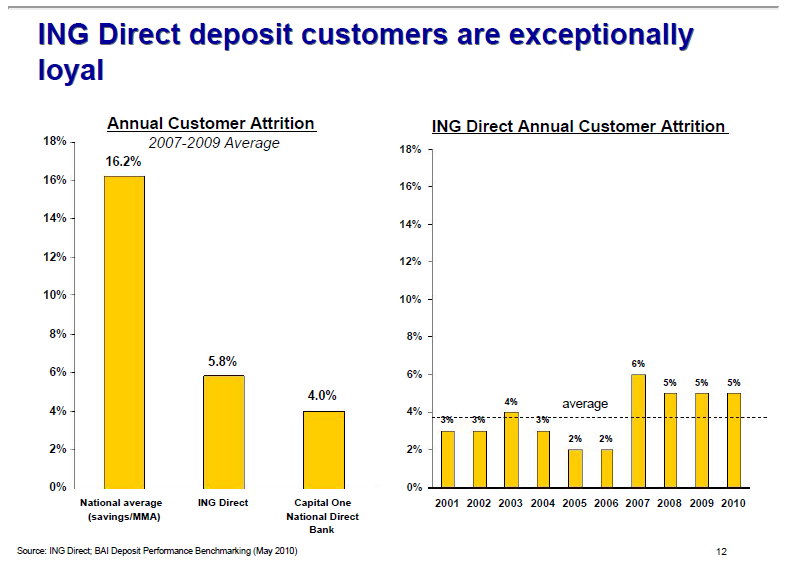

This slide shows the customer attrition of direct banks. The first panel shows the reduced customer attrition of ING Direct and Capital One’s direct bank compared to the national average for savings and money market accounts.

Why is the national average attrition of deposit accounts so high? One reason for this may be due to customer migration. When someone moves to a new city, they often have to find a new bank. But, with direct bank accounts, there is no need to find a new bank when you move. Another reason may be clientele of direct banks are higher-end, so they are opening and closing accounts less often. The second panel shows ING Direct’s customer attrition through time. While the overall level is low, the attrition did pick-up with the approaching financial crisis and remained at the higher level. An interesting question is if the higher attrition is due to additional competition in the direct bank space.

Getting back to the original question of whether the deposit franchises of direct banks have franchise value, I would say the market doesn’t believe that they do. But, I believe we see evidence of stability in the deposit customer base in the slides that Ally Financial presented at a recent conference. Maybe we will see the market begin to change its view if the direct banks continue to grow through this rate tightening cycle without having to continue to pay high rates.