Bank investors often measure the franchise value of a bank by looking at the quality of the deposit franchise. Deposits are so difficult to raise that they provide the best point of differentiation among banks. After all, the asset side of a bank’s balance sheet is more commodity-like. Banks often make large corporate or real estate loans after the borrowers have shopped the loan to several banks. Consumer lending has consolidated to the large consumer-focused banks. Loans tend to be more transactional. But deposits are more relationship based, are harder to gather, and tend to be stickier part of the bank’s balance sheet.

When looking at deposits, bank investors look at deposit costs and product types. Non-interest checking balances have the most value. At the opposite end of the spectrum are brokered deposits, which may have negative value. The spectrum of bank deposits compared to value may look like this (ranked by most valuable to least valuable):

1.) Non-interest bearing checking

2.) Interest checking

3.) Savings

4.) Money-market accounts

5.) Retail CDs

6.) Government Deposits

7.) Jumbo CDs

8.) Brokered Deposits

With the introduction of ING Orange savings accounts 15 years ago, direct banking over the Internet created a new type of deposit account and a new type of depositor. The initial attraction of these online savings accounts was high rates paid on the deposits. These online savings accounts paid rates more comparable to money market mutual funds. Bank investors thought these deposits only existed due to the high rates paid, so they equated these deposits in the direct banks as the equivalent of brokered deposits.

The conventional wisdom that direct banks’ deposit franchises have little value may be wrong. They may be less valuable than a classic regional business banking franchise, but they seem to be providing more stable funding than capital markets or wholesale funding. Customers of direct banks have gotten into habits that make them sticky. They like the ease of use of the direct bank platforms. They like the rebated ATM fees, free wires, or better mobile apps. Some of these customers have developed emotional connections with their direct banks.

In Ally Financial’s November 2017 presentation to the BancAnalysts of Boston conference, the management presented several interesting slides that should cause bank investors to rethink whether they place a low value on direct bank deposits.

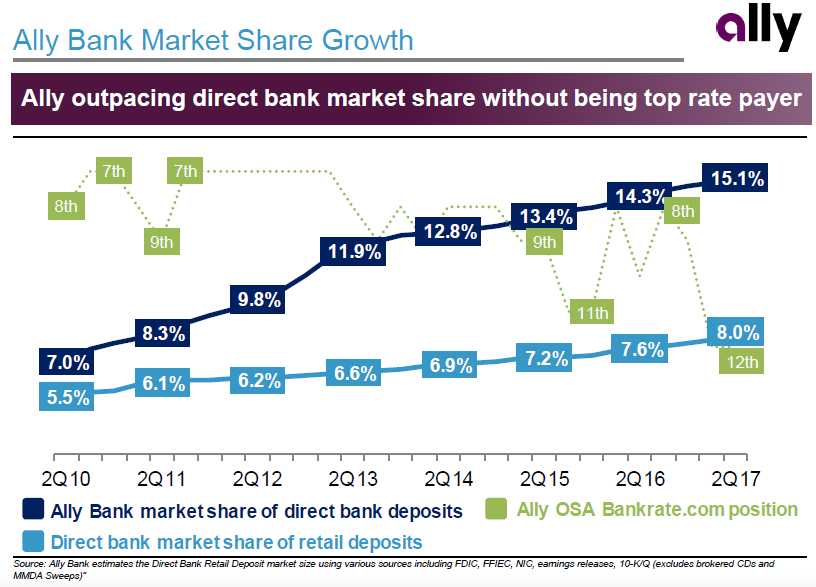

This slide is shown to provide evidence that Ally’s deposits are not dependent on paying the top rate.

Ally has doubled its market share among direct banks, but it has steadily moved down the ranking among top deposit payers. However, there are a couple of other things we observe from this slide. Direct banks are consistently gaining deposit market share. We can also calculate that Ally has tripled its national deposit market share in seven years.

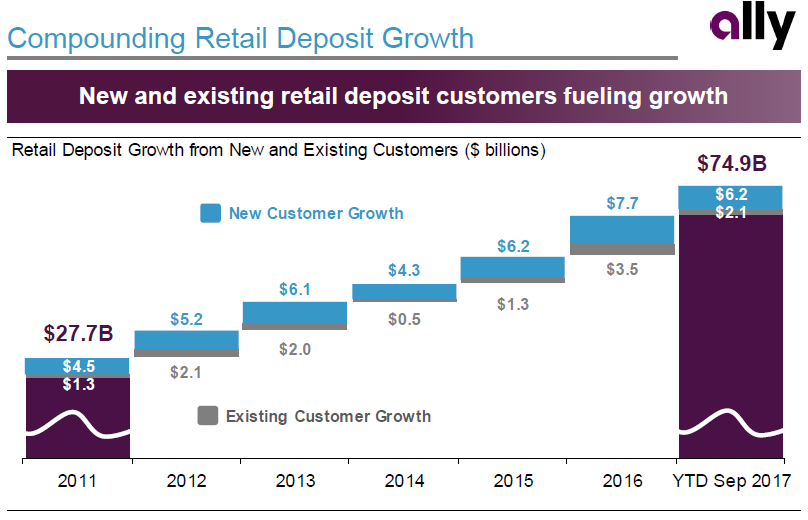

This slide shows that Ally’s deposit growth comes mostly from new customer deposits, but Ally also gets growth from its existing customers.

The growth of existing customer balances is important when thinking about the lifetime value of a customer because it seems that growth from remaining customers offsets attrition from lost customers.

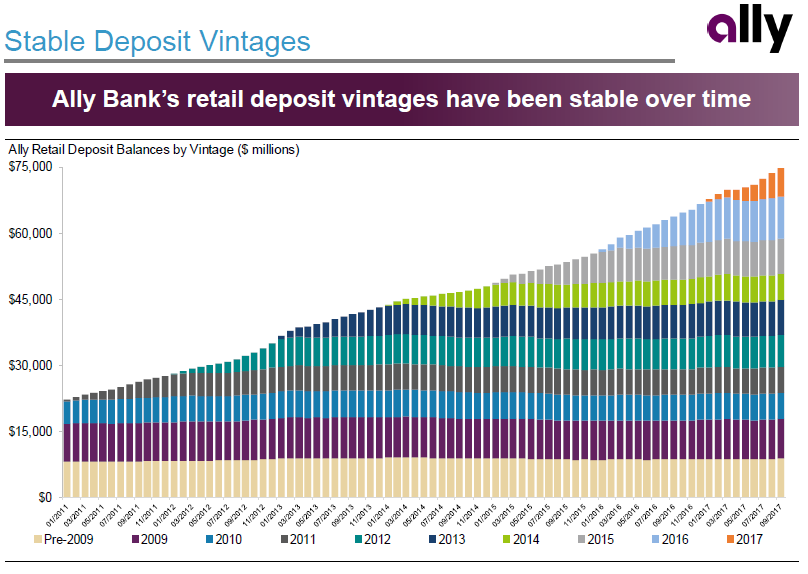

This slide shows the stability of each vintage of customer deposits. The stability of balances from each vintage of customers is remarkable.

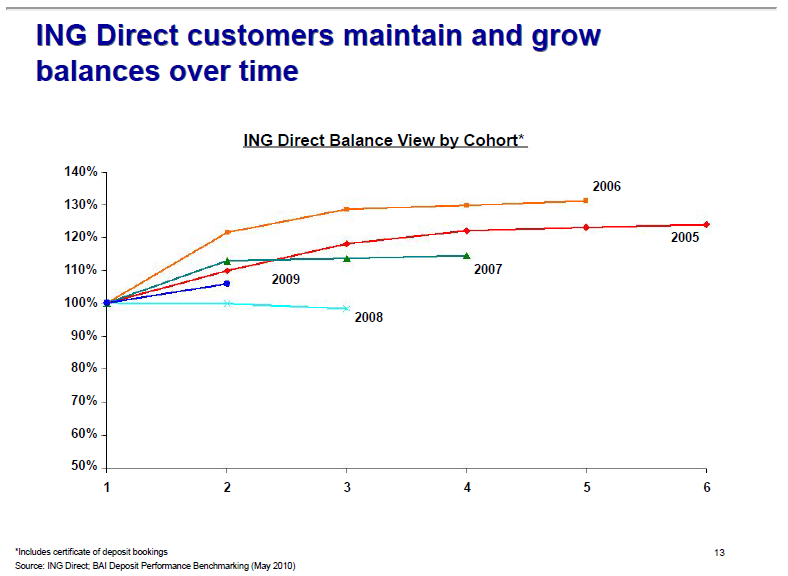

This slide reminds me of a similar slide that Capital One provided in its June 2011 announcement of its acquisition of ING Direct. Capital One shows that ING Direct’s customer balances were stable to even positive years after the customer opened the account.

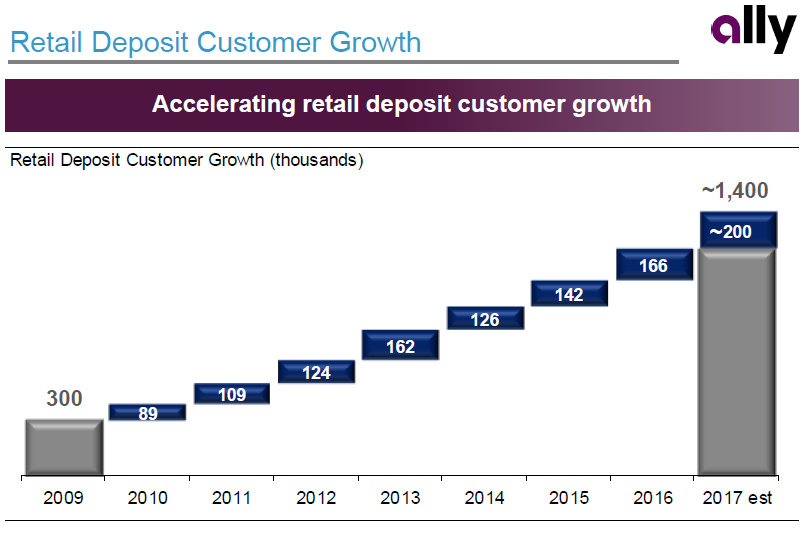

This slide shows the number of new customers that Ally has gained each year.

We can see that the number of new customers is accelerating in recent years. Since we know that Ally has $88 billion of retail deposits and they show us that they have 1.4 million customers, it looks like the average customer deposit account is $60k. The next time I talk with IR, I’ll have to ask what the median retail deposit customer account is.

Earlier, I referred to Capital One’s 2011 acquisition of ING Direct. At the time, ING Direct was the largest direct bank in the US with $77 billion of deposits. ING was forced to divest of their U.S.-based operations as a condition of their bailout by the Dutch government in 2008. At the time, ING Direct had $77.7 billion of deposits. Capital One paid a low premium for ING Direct of 122% of book value or 2.15% deposit premium, which reflected what a low value the market placed on direct banking deposits.

In addition to the customer vintage slide shown earlier, there are a few other slides from the Capital One presentation that I think are worth reviewing when thinking about whether direct banks have franchise value.

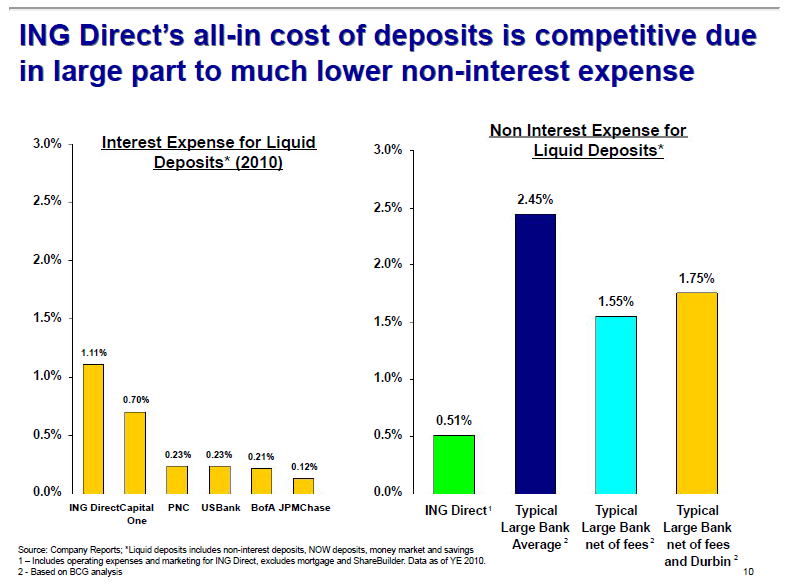

This slide shows how ING Direct’s all-in cost of deposits in 2010 was lower than other bank franchises due to the costs of running a branch system.

Capital One estimated ING Direct’s cost of deposits at 1.11% and non-interest expenses at 0.51% for an all-in cost of deposits of 1.62%. They compared this to several major banks, but looking at Bank of America for simplicity, they estimated B of A’s cost of deposits at 0.21% and their non-interest expenses for a typical large bank at 1.75% adjusting for fees earned and lower debit card interchange due to the Durbin Amendment for an all-in cost of 1.96%.

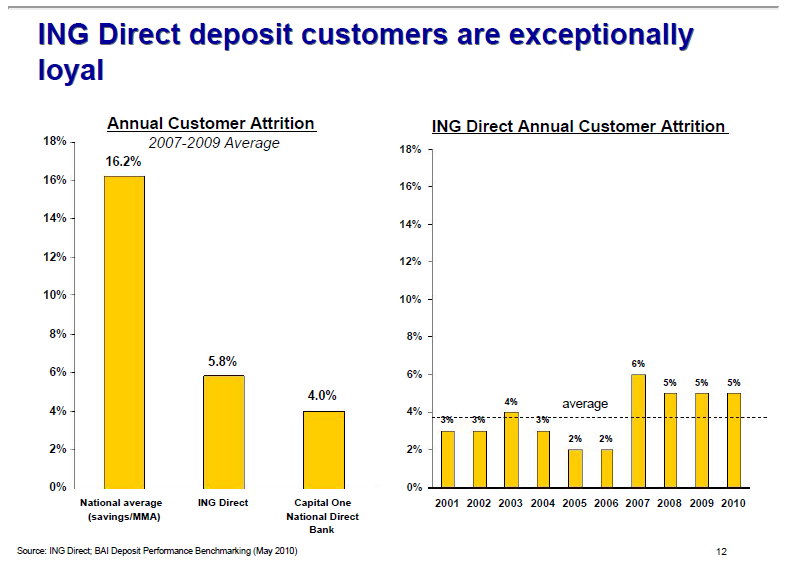

This slide shows the customer attrition of direct banks. The first panel shows the reduced customer attrition of ING Direct and Capital One’s direct bank compared to the national average for savings and money market accounts.

Why is the national average attrition of deposit accounts so high? One reason for this may be due to customer migration. When someone moves to a new city, they often have to find a new bank. But, with direct bank accounts, there is no need to find a new bank when you move. Another reason may be clientele of direct banks are higher-end, so they are opening and closing accounts less often. The second panel shows ING Direct’s customer attrition through time. While the overall level is low, the attrition did pick-up with the approaching financial crisis and remained at the higher level. An interesting question is if the higher attrition is due to additional competition in the direct bank space.

Getting back to the original question of whether the deposit franchises of direct banks have franchise value, I would say the market doesn’t believe that they do. But, I believe we see evidence of stability in the deposit customer base in the slides that Ally Financial presented at a recent conference. Maybe we will see the market begin to change its view if the direct banks continue to grow through this rate tightening cycle without having to continue to pay high rates.

We purchased additional common shares of Kingstone Companies, Inc. (NASDAQ: KINS) in late January when the company raised capital in a follow-on offering at $12 per share. The stock has increased in the last week, but we were editing and getting this post through compliance. So, this post is not timely. We are sharing it to show our thought process. We’ve owned shares in Kingstone since their previous equity offering in December 2013 at $5.95.

Kingstone is a homeowners insurance company based in New York state. The company has grown quickly since Superstorm Sandy as Allstate and State Farm have reduced their coastal exposures on Long Island. Kingstone also writes insurance on several smaller lines such as physical damage on livery, which is purchased by Uber drivers, and commercial lines.

We like Kingstone for the following reasons:

1. Strong organic growth –Kingstone has been posting strong gross written premium growth. The company has benefitted from large insurers, such as Allstate and State Farm, reducing their exposures to coastal areas, especially Long Island. We believe these large insurers reduced risk systematically along the coast without consideration for pricing, so Kingstone has been able to grow while being able to price the risk appropriately.

We believe Kingstone will continue this strong growth by expanding into adjacent states like New Jersey and Connecticut. Homeowners insurance is a product that every homeowner is required to buy. Kingstone has carved out a niche among independent insurance agents by providing superior service without channel conflict.

2. High returns –Kingstone has stated goals of 20% earnings growth, 20% operating margins, and a 20% return on equity. We think these goals may be too ambitious in light of management wanting to keep premium-to-equity leverage at 1.5x, but we like that management is trying to generate attractive returns.

3. CEO is a proven money maker –With any small company, we believe the management is even more important because their decisions have higher impacts on the business. We think very highly of Barry Goldstein, Kingstone’s CEO. In our interactions with him, he has been thoughtful and very astute about insurance. He has shown the ability to recognize business opportunities but is able to balance this to protect his downside risk. For example, he has exited lines of business where the economics are poor, such as commercial auto. Goldstein is Kingstone’s largest shareholder. Even though he sold a portion of his holdings in the most recent equity offering, we still believe his interests are closely aligned with other shareholders. We believe he is an owner-operator and not an employee-manager, so he will sell Kingstone if an appropriate offer is made. We believe he has no interest in hanging around to collect a paycheck.

4. New capital will drive earnings higher –Kingstone recently raised $30 million in a follow-on equity offering. The company will use this capital to reduce the amount of quota-share reinsurance it buys. The company has grown so quickly that it had to use quota-share reinsurance to support of its growth. The company has steadily reduced the amount of quota-share insurance from 75% to 55% to 40% as it has grown its capital. We believe they will lower the amount of quota-share reinsurance to 20% on July 1st. The company still uses a conservative amount of excess-of-loss reinsurance to protect itself from storms.

5. Active buyer of reinsurance –Kingstone buys catastrophe reinsurance to protect itself from a 1-in-250 year storm. We believe this is more conservative than its Florida peers. Kingstone has been using the declining reinsurance price environment to further protect its balance sheet. With its current reinsurance treaty, if Kingstone were to have a large loss, it would simply wipe out one quarter’s earnings. It would not impact its equity capital.

6. Expecting a ratingsupgrade which will drive business volumes –With the recent capital raise and continued increases in catastrophe reinsurance purchased, management believes that A.M. Best will raise the company’s rating from B+ to A-. Such an increase will help the company write additional business. Many insurance agents will not place policies with companies with ratings lower than A- from A.M. Best. The potential ratings increase will help accelerate new business as the company enters new states.

7. Thoughtful, consistent expansion –Kingstone has methodically planned its expansion beyond New York state. It has licenses to write homeowners in Pennsylvania, New Jersey, Connecticut, Rhode Island, and Texas. It has decided not to enter Texas because management could not get comfortable with the severity of windstorms in recent years. Instead, Kingstone has recently started to write homeowners in New Jersey and will begin to write policies in Connecticut and Rhode Island later in 2017. These states have similar weather patterns and clientele to New York.

8. Valuation is attractive –With the recent capital raise, Kingstone is trading at 1.5x book value or 6.5x our $1.95 estimate of 2018 earnings per share. With Kingstone’s 20% growth rate, unique positioning in the northeastern US, and lower likelihood of hurricanes compared to its Florida-based peers, we believe the stock should trade at a significant premium to the 8.5x 2018 earnings at which the Florida-based homeowners insurance companies currently trade.

9. Candidate for consolidation –At less than $200 million in market capitalization, Kingstone would be a bite-sized acquisition for another insurance company. For the Florida-based homeowners companies, there would be risk diversification benefits from owning Kingstone’s NY state book of business. For example, a homeowners company with exposure to Florida and New York would be charged lower reinsurance rates than a company writing solely in Florida.

10. Investment by RenaissanceRe Ventures –In early 2016, RenaissanceRe, the well-regarded catastrophe reinsurance company, approached Kingstone to make an investment. They invested $5 million through a private placement of Kingstone common stock by their venture capital arm. We infer from this investment that a smart player in catastrophe reinsurance liked the opportunity Kingstone has in homeowners insurance. We believe RenaissanceRe has given Kingstone informal advice on its reinsurance program since making the investment, which raises our comfort level.

Risks

1. Higher operational risk due to small organization –Small companies have a greater risk of an operational misstep. Fewer people are involved in making decisions. Key executives may have to fill multiple roles, so the level of expertise may be lower. We do not have any specific concerns regarding Kingstone. Rather, we note they are small.

2. Potential for higher competition –Kingstone has benefitted from the vacuum left behind by State Farm and Allstate when they decided to reduce their exposure to Long Island. If these giant competitors reversed course and wanted to increase their exposure to Long Island, they could take business away from Kingstone. We would note that these companies have steadily retreated from Florida since Hurricane Andrew hit in 1992, so we don’t think these companies will reverse course without serious consideration.

3. No direct writing capability –Kingstone has focused on distributing its policies exclusively through independent insurance agents. As we all know from the never-ending TV ads, auto insurance companies have convinced customers to come to them directly to cut out the agent. This shift to direct distribution has lagged in the homeowners insurance market. If direct writing in the homeowners insurance market catches up to the auto insurance market, Kingstone is not well positioned. That being said, there will always be some portion of the homeowners insurance market that will be sold through brokers. Within the independent brokerage channel, Kingstone has such a small market share that the channel can shrink and Kingstone would still have plenty of room to grow.

4. Catastrophe reinsurance market may tighten –Kingstone has benefitted from the loose market for catastrophe reinsurance. There have not been significant losses in catastrophe reinsurance since the 2005 hurricane season, so catastrophe reinsurance prices have declined for several years. As these prices have declined, Kingstone has used the lower prices to buy the same dollar amount of reinsurance but has been able to secure higher levels of coverage. If the catastrophe reinsurance market were to tighten, Kingstone would have to pay higher rates for reinsurance. This could squeeze Kingstone profit margins if the company is not able to raise rates to its customers.

Overall, we believe Kingstone is an undiscovered gem of an insurance company. The company has an attractive growth opportunity in front of it. As shareholders, we are aligned with a money making CEO. We like that the management has high return targets. We believe the company will compound our capital at attractive rates for several more years. Eventually, we believe Kingstone will become part of a large organization.

DISCLOSURE

The ideas expressed in this posting are the views and opinions of the author of this posting (Author). The Author has no obligation to update any of the information contained herein and has no obligation to update the posting to reflect any changes in the Author’s opinion on any of the companies or topics contained herein. Do not rely upon the information contained in this posting for making investment decisions; prepare your own analysis or contact your financial advisor. While the Author has tried to present facts it believes are accurate, the Author makes no representation as to the accuracy or completeness of any information contained in this note. Past performance is not necessarily indicative of future results, and there can be no assurance that targeted or projected returns will be achieved. This is not a recommendation to buy or sell any security discussed herein.

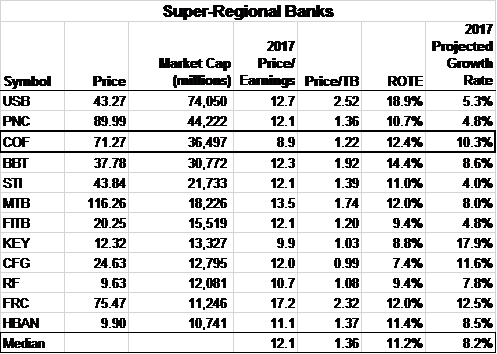

Capital One stock is interesting because we believe it has the best combination of growth and value among the super-regional banks. With its mix of national lending platforms and online deposit gathering franchises, it is our opinion that Capital One has the best strategic positioning of super-regional banks. The company is posting the best growth rate among the credit card issuers. The non-promotional management team has been positive about the growth opportunities that they currently see. The company’s stock trades for less than 9.0x 2017 Bloomberg’s consensus estimated earnings per share compared with similarly sized banks trading more than 12.0x. Capital One has been returning excess capital to shareholders by repurchasing 6% of outstanding shares per year for the past few years. We think the downside is limited as Capital One trades at 1.2x tangible book value.

We think Capital One is the best positioned of the super-regional banks. Capital One is unique among the super-regional banks in that it has national lending platforms for credit cards and auto finance. These two lending segments have consolidated and peers would have difficulty entering these businesses beyond cross-selling to their existing customers. We believe the growth rates and the returns from these two segments are higher than the typical bank loan portfolio of business loans, commercial real estate loans, and mortgage loans. In late 2015, Capital One added another national lending platform by acquiring General Electric’s Healthcare Finance unit. We give credit to Capital One’s management team for realizing years ago that certain lending businesses would consolidate nationally. Then, they positioned the company to ensure they will be one the long-term players in these markets.

Capital One is also in a better position than its peers with both local and online deposit gathering franchises. Over the last ten years, Capital One improved its liability profile by acquiring banks in New York, Washington, DC, and New Orleans. These banks were primarily acquired for their deposits, but they each had reasonable commercial lending businesses. Capital One has continued to operate these commercial lending businesses in the local markets because they earn more than their cost of capital, but they have lower growth and returns than Capital One’s national lending businesses. In 2012, Capital One enhanced its deposit franchise by acquiring ING Direct, one of the pioneers in online banking. This acquisition gave Capital One the leading position in online deposit gathering. Although the banking system has been awash in deposits since this acquisition, this online deposit gathering scale will enable Capital One to maintain its growth rate when industry deposit growth is less robust. With the combination of national lending platforms, local deposit franchises, and the online deposit gathering presence of ING Direct, we believe Capital One will able to grow faster and earn higher returns than the other super-regional banks.

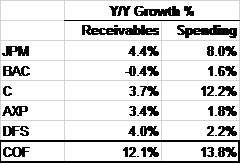

We also think investors are overlooking the best-in-class growth rate of Capital One’s credit card business. The table below shows Capital One is growing both credit card receivables and credit spending by its customers faster than the other major credit card issuers. We believe Capital One’s growth is driven by

As of 6/30/2016

Source: Company reports, Gator Capital Management

Note: C & AXP data have been adjusted for sale of Costco portfolio management’s long-term marketing campaigns focused on rewards and building the best card products with 1.5% cash back (Spark) and double miles cards (Venture). We think Capital One differentiates itself from peers because of a willingness to forgo current earnings for business enhancing investments for customer acquisition or advertising that have a long-term positive net present value. Often, these investments detract from earnings in the current period. An example of this business investment is the 15% annual increase in marketing spending over the past two years, which has accelerated receivable growth from 1% to 12%. However, Capital One’s earnings per share over this time period is flat as the additional revenue from the receivable growth has gone to pay for the marketing spend and to add to its loan loss reserves. While companies in other industries are rewarded for deferring earnings in favor of growth investment, bank investors may be hesitant to give Capital One credit for their growing credit card portfolio until they see evidence of earnings growth. We see this as an opportunity to buy Capital One at an attractive valuation with growth on the horizon.

Capital One’s management has a history of discussing their business in a non-promotional manner, so we take note when we hear them talk enthusiastically about their current prospects. Capital One does not manage earnings or give earnings guidance. Instead, the management team talks in terms of business drivers on earnings conference calls or at investment conferences. When management sees an opportunity to grow the business through additional investment, they will spend the money even if it means they will “miss” the quarter due to the extra expense. On recent conference calls, Capital One’s management has talked favorably about the long-term benefits of the recent growth even though current earnings are not reflecting the recent balance growth of the company’s credit card business.

Capital One’s growth is not only compelling versus other credit card lenders, but its valuation is compelling versus other super-regional banks. As you can see from the table, Capital One has the

Source: Bloomberg, Gator Capital

Pricing date: close of September 13, 2016 close lowest valuation of the super-regional banks on a Price-to-Earnings basis. Four banks (FITB, KEY, CFG & RF) have lower Price to Tangible Book Ratios, but each of these banks have lower returns on equity than Capital One.

While we believe Capital One is compelling, we need to acknowledge the bearish arguments against our position:

We think Capital One’s stock is interesting at this time because it has asymmetrical returns. With the stock at $71, we see upside to $126 and downside to $58 by the end 2018. With these targets and dividends, the upside case is +32% annualized return and in the downside scenario the annualized return is -7%.

DISCLOSURE

The ideas expressed in this posting are the views and opinions of the author of this posting (Author). The Author has no obligation to update any of the information contained herein and has no obligation to update the posting to reflect any changes in the Author’s opinion on any of the companies or topics contained herein. Do not rely upon the information contained in this posting for making investment decisions; prepare your own analysis or contact your financial advisor. While the Author has tried to present facts it believes are accurate, the Author makes no representation as to the accuracy or completeness of any information contained in this note. Past performance is not necessarily indicative of future results, and there can be no assurance that targeted or projected returns will be achieved. This is not a recommendation to buy or sell any security discussed herein.

We purchased SLM Corporation (“SLM”) this summer because it was trading at 10x 2017 estimated EPS and is growing its loan portfolio more than 20% annually. SLM is the renamed student loan company formerly known as Sallie Mae. The student loan industry has gone through significant changes over the last 10 years. The industry used to originate a mix of government guaranteed loans and private loans. In 2010, the government ended the program of third-party lenders making government guaranteed loans. Now, the government makes direct student loans for up to $31,000 per student for the four years of college. Student lenders, like SLM, provide private student loans for costs above $31,000.

In 2014, SLM split into two companies: SLM and Navient. SLM retained the student loan origination platform and the newly created banking operation. Navient took most of the existing portfolio of student loans and the student loan servicing and debt collection platforms. At the time of the spin-off, we thought SLM was interesting because it would grow very quickly and we thought the student loan origination platform was a valuable asset, but we didn’t buy the stock because it traded at 25x earnings and a portion of the earnings were gains from selling new loan originations.

After the 2014 separation between SLM and Navient, SLM owned a new banking subsidiary and retained the large, dominant student loan origination franchise. SLM’s economic model was earning revenues from two sources: the net interest spread on loans it retained and gain on sale income on excess loan originations it sold. The reason SLM sold any loans was due to restrictions regulators placed on the growth of SLM’s banking subsidiary. Regulators typically place additional growth and capital limits on new banks because these growth restrictions reduce risk. This is a reasonable regulatory practice because history has shown that new banks are more likely to have problems and/or fail. SLM originates $5 billion of new student loans per year, but their banking subsidiary was not allowed to grow at a rate that would absorb all of these originations, so it sold the loan originations that it could not retain into the capital markets. SLM’s student loans are very attractive to buyers because they have high credit quality, they are variable rate, and they have spreads between 4% and 8% above Libor. In 2014 and early 2015, buyers paid a 10% premium for SLM’s excess loan originations.

In 2015 and early 2016, SLM’s stock price declined due to a decline in earnings from selling new student loan originations. This stock decline was interesting to us because we had placed a low value on the income from selling loans. Midway through 2015, the buyers stopped paying 10% premiums for SLM’s loans and only offered 6% premiums. This lower price led to lower revenue and earnings for SLM. SLM’s management team didn’t like selling the loans in the first place, but they had to because of the growth limits. When the market lowered the premium they were willing to pay SLM, SLM management went to their banking regulator to ask for a growth waiver, so they could retain the loans. SLM’s regulator granted the growth waiver, so SLM’s management could stop selling loans entirely and retain the loans on SLM’s balance sheet. We think it is better for SLM to retain the loans, have higher-quality recurring earnings and a faster growth rate. SLM’s stock declined during this time because near-term earnings estimates declined as gain on sale revenue and income went away completely.

The two main risks to the SLM investment thesis are a potential change to how student loans are handled in bankruptcy cases and some unforeseen problem with SLM’s credit underwriting. Borrowers still have to pay their student debt even if they declare bankruptcy. Congress would have to pass a law to give borrowers relief in bankruptcy. We don’t think a change will happen in the medium-term, but we constantly worry about a possible change. We believe SLM’s underwriting is strong and has improved by using higher credit scores, having more loan co-signers, and focusing on schools with higher graduation rates. But, we can always get a credit surprise, so we monitor SLM’s credit metrics to see if we can detect any bad trends.

At recent prices, SLM trades at 10.9x 2017 estimated EPS and is growing >20%. We think other investors will recognize this as the company reports earnings over the next year. In addition, we believe SLM’s dominant 50% market share of private student loan originations is attractive to a major bank looking to grow their balance sheet.

Disclaimer: The discussion of any security is meant solely as an illustration of our investment and thought process and should NOT be considered as a recommendation or suggestion to buy or sell any securities. Before you make any investment, do your own research and talk to your own financial adviser. Information in this report is received from external sources. Therefore, we can make no guarantee as to the completeness or accuracy of the information provided.

Not all research is for securities currently held. Any securities for which research is provided herein may be reduced, completely closed out, or not purchased at all without notice of any kind.