Regional bank stocks have had an epic run over the past eight months. From September until May, the SPDR S&P Regional Banking ETF (“KRE”) returned 101%. After such a large move, we believe regional banks have shifted from extremely undervalued to fairly valued. However, we think there is still opportunity in small banks due to their low valuations.

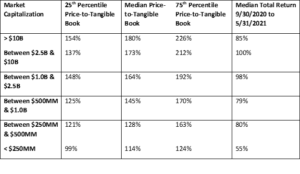

Here is a table showing the median Price-to-Tangible Book Value (“P/TBV”) of banks grouped by market capitalization. As you can see, the median P/TBV declines as the market capitalization declines.

Not only are the median values higher for larger banks, but we can see the range of values is wider and higher.

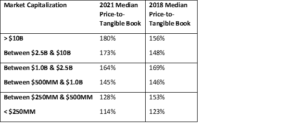

The current distribution of bank valuations has important implications for bank mergers and acquisitions. With larger banks trading for higher valuations, they can use their stocks as currency in mergers and acquisitions, and the “merger math” will be attractive to investors. Here is a table comparing the distribution of bank valuations in 2021 to valuations in 2018.

As shown in the table, in 2018, valuations were more consistent across different-sized banks. The similar valuations made mergers more difficult because the financial benefits of mergers were less compelling.

We see two main reasons for the current distribution of bank stock valuations. In recent months, the stock market has been driven by the pandemic reopening trade. Ever since Pfizer announced positive news about their COVID-19 vaccine in November, stocks of companies that would benefit from the end of the pandemic, such as banks, have rallied. We believe non-traditional bank investors have moved into banks by purchasing exchange-traded funds and stocks of the largest, most liquid banks. This has led to the largest banks having higher valuations.

A likely reason for the lower valuation of banks with market capitalizations below $250 million is the annual reconstitution of the Russell indices. Each June, the Russell indices are remade as stocks are shuffled in and out of the Russell 1000 and Russell 2000. This year is unusual because of the strong stock market rally and because of the large number of initial public offerings, so the minimum market capitalization for companies in the Russell 2000 is close to $250 million compared to $90 million in 2020. This means about 79 small-cap banks are leaving the Russell 2000 index on June 25th. We think this is widely known by small bank investors, so small-cap bank stocks are trading at lower valuations.

Currently, we believe the best opportunity in bank stocks is among small banks because they trade at lower valuations.

JP Morgan Chase’s (“JPM”) stock price has had a great run in 2019. Up 42% year-to-date, JPM now trades at 2.33x tangible book value per share (“TBVPS”). JPM has been repurchasing a ton of its own stock. In June, the Federal Reserve did not object to JPM’s plan to repurchase $29.4 billion of stock over the next 12 months. In Q3, JPM repurchased $6.7 billion of stock. However, at this valuation, the company is not enhancing shareholder value with its stock repurchases and should pause stock repurchases until there is a better opportunity to deploy capital.

Stock repurchases when the stock trades above book value hamper tangible book value growth. When a bank’s stock trades closer to tangible book value, and the bank has excess capital, it makes sense to use the excess capital to repurchase stock. The earnings per share of the bank increases due to the lower share count and book value is not affected by much. By repurchasing stock at 2x tangible book, earnings per share increase marginally, but tangible book value declines. After three years of higher earnings per share, the bank’s tangible book value recovers the initial dilution. Repurchasing shares at multiples of TBVPS above 2x pushes out the recovery of book value further both because the initial dilution is greater and the increase in earnings per share is reduced.

Financial stocks go through valuation cycles, and book value will matter in the next downturn. With JPM’s financial success over the past 10 years, investors and analysts are valuing the bank on a price-to-earnings basis, rather than, a price-to-TBVPS basis. But this will not always be the case. When we go through the next turbulent economic period, investors may once again consider JPM’s stock compared to its tangible book value. At that time, it will have been better not to dilute book value through stock repurchases at high multiples of tangible book. In fact, most of JPM’s competitors are valued by investors primarily on price-to-tangible book, such as Citigroup, Goldman Sachs, Credit Suisse, and Barclays.

The bank is better off retaining capital and deploying it when opportunities are more attractive. When a bank defers deploying excess capital into stock repurchases, the option to repurchase stock in the future still exists. If the stock were to decline, the bank could buy more shares back at a better valuation. Berkshire Hathaway does this by making their buyback dependent on the stock’s valuation. The Sandler Family at Golden West Financial were among the best at timing the repurchases of their own stock. They waited for the valuation to be attractive. Raymond James Financial’s management team has long had a 1.5x book value target for buying back their stock.

JPM’s alternatives to repurchasing stock are limited because they already invest as much as possible into organic growth, and their acquisitions are limited due to their existing market share of banking deposits. JPM’s best use for capital is to reinvest in its core business. However, JPM generates so much capital that it can only reinvest 30-50% of the new capital generated in its business. Normally, bank management would look to make acquisitions as the second best use of capital, but in 1994, the Riegle-Neal Interstate Banking and Branching Efficiency Act imposed a provision that limited banks from making acquisitions if after the combined entity’s market share of bank deposits was greater than 10% nationally.[1] As of 2018, JPM’s market share of deposits stood at 10.35% (banks are allowed to grow organically above the 10% threshold). This law prevents JPM from acquiring any company that has deposits, so it can’t enter new markets like Philadelphia and Boston by acquiring a small competitor. It also prevents them from acquiring an online broker like E*Trade because E*Trade operates a bank and has deposits.

One potential avenue for JPM to pursue in M&A is purchasing loan portfolios from other banks. An example might be a credit card portfolio or a specialized lending platform. However, we have not seen JPM be aggressive in this area even though there has been ample opportunity for them. Examples of deals they passed on were the Costco and Wal-Mart credit card portfolios or the various lending portfolios of GE Capital that came to market as General Electric was exiting financial services.

The most realistic option for JPM’s excess capital is to retain it and wait for a better opportunity to deploy it. The opportunity that will likely come will either be a decline in JPM’s stock price or an improvement in JPM’s valuation because the earnings grow into the current stock valuation.

Another long-term opportunity for deploying excess capital could be if the 10% deposit caps are lifted. I believe that the current political climate for large banks makes this scenario unlikely, but if we had another time of financial stress, we could see a scenario where the deposit cap is lifted so large banks could acquire distressed banks. JPM acquired Bear Stearns and Washington Mutual in 2008. In late 2008, there was some speculation that the 10% deposit cap would be lifted in a scenario where additional institutions needed to be acquired.[1]

Not everyone will agree that JPM should pause stock repurchases. Some may argue that excess capital could be trapped at the big banks. Another argument might be return on equity will decline if banks hold excess capital. Others may fret that pausing share repurchases is a poor signal to send to investors. And others may worry that excess capital retained by management will be wasted.

I believe a reasonable argument is the regulatory window is open for repurchases, so JPM should continue to use repurchases to get excess capital back to shareholders while the Fed is permissive. I would argue that the Federal Reserve has reached a steady state with the CCAR stress tests and with banks using repurchases to return excess capital. In fact, we have seen instances where the Fed has allowed banks to repurchase stock greater than 100% of their net income in an effort to manage down their capital ratios. I believe the current Fed policy regarding stock repurchases and managing down capital levels is a semi-permanent policy position. JPM management and shareholders should not worry about trapping capital if management paused buybacks because the stock price is too high.

Some investors may worry that Return on Equity (“ROE”) will decline if the company retains excess capital. Yes, this is the math. If the company retains equity that it can’t use in its business, then the ROE of the company will decline. Of course, the core ROE of the business remains unchanged. The company will just have excess capital. It could use the excess capital in the future. I believe stock market investors are adept at evaluating what a bank’s core ROE is and how much excess capital it holds.

Proponents of continued repurchases may argue that by pausing the stock repurchases, the company will be sending a bad signal to investors. After all, if the company thinks the stock is too expensive to buy, then why should investors buy the stock for themselves? This view assumes that all investors use the same framework for investments at the company. Some investors use momentum framework. Others look at earnings revisions. Because a company’s decision to repurchase stock is a semi-permanent one, they should use a long-term, value-based approach.

Others may argue that the company should return excess capital to shareholders so they can redeploy the funds into other businesses that need the capital. My view of this is the shareholders who would sell into a repurchase by the company can still sell into the current share price to redeploy their capital into other businesses. It doesn’t matter to them, nor do they know whether the company is buying their shares. The reason JPM’s stock price is so high is because shareholders don’t see other opportunities to redeploy their capital.

My opinion that JPM should pause their stock buybacks due to the stock’s high valuation is not controversial. It is basic corporate finance. I also believe that Jaime Dimon would agree with me. In fact, he’s made several public statements expressing a similar opinion.

“I would prefer to spend that money not buying back stock but doing [building bank branches.]… Growing our business is far better for the economy. Right now we don’t have a lot of choices. But over time I really would prefer not to buy back stock.”[2]

“Stock buyback, in my opinion, is a very good thing to do when your stock is cheap… The highest and best use of our capital is reinvesting it and we are starting to do that now… This notion that you should buy back stock at three times tangible book value as a return of capital to shareholders is crazy.”[3]

In his letter to shareholders in the 2018 Annual Report, Dimon talks about share buybacks at 1x tangible book versus 2x tangible book:

“In prior letters, I explained why buying back our stock at tangible book value per share was a no-brainer. Seven years ago, we offered an example of this: If we bought back a large block of stock at tangible book value, earnings and tangible book value per share would be substantially higher just four years later than without the buyback. While we prefer buying back our stock at tangible book value, we think it makes sense to do so even at or above two times tangible book value for reasons similar to those we’ve expressed in the past. If we buy back a big block of stock this year, we would expect (using analysts’ earnings estimates) earnings per share in five years to be 2%–3% higher and tangible book value to be virtually unchanged.”[4]

As

the JPM’s stock valuation rises above 2x TBVPS, the earnings accretion declines

and the tangible book value recovery extends to future years. Current share repurchases reduce optionality

for future capital deployment if opportunities appear. With JPM trading at 2.33x TBVPS, management

should pause the share repurchases and hold onto the excess capital. I would not be surprised if management made

some commentary to this extent on their earnings conference call on January 14th.

1 https://ilsr.org/rule/market-share-caps/

2 https://www.thestreet.com/investing/stocks/bank-ma-may-hinge-on-deposit-cap-rule-10446267

3 https://www.cnbc.com/2018/09/24/jp-morgans-dimon-says-he-would-prefer-not-to-buy-back-stock-over-time-and-instead-grow-the-business.html

4 https://www.reuters.com/article/us-jpmorgan-dimon-conference/jpmorgan-ceo-dimon-buybacks-are-for-times-when-stock-is-cheap-idUSKBN1O325N

5 https://www.jpmorganchase.com/corporate/investor-relations/document/ceo-letter-to-shareholders-2018.pdf

As we head into September, the stock market is making all-time highs, but many investors we speak to are worried about a recession. Many investors think ten years of economic expansion suggests a recession is right around the corner. We are not so sure. While there are some headwinds in the economy: trade tariffs, health care costs, student loan burdens, significant disruption in retail businesses, we think the economy is in good shape. Banks have not increased their high-risk lending relative to their capital as they did in past cycles. We believe demographics continue to favor significant household formations, which is a driver of economic activity. We still need faster economic growth to catch-up to long-term trend economic growth from when we were thrown off trend by the 2008-2009 recession.

The juxtaposition of the stock market making all-time highs and investors worried about a recession can be seen very clearly in the valuations of stocks in the Financials sector. Investors are placing valuations on many Financials sector stocks like we are headed into a recession. So, if you are more bullish on the economy like us, a very good way to express your economic optimism is to own some Financials sector stocks.

Below we review some of the cheapest stocks in the Financials sector. We believe investors have been avoiding these stocks because they fear we are headed into a recession.

Investment banks – GS, MS, JEF, COWN – Morgan Stanley trades just above book value. Goldman trades at book value. And, Jefferies and Cowen trade at significant discounts to book value despite being profitable. We know that FICC and Equities trading is in secular decline. Each of these companies are buying back serious amounts of their shares. We believe there are different catalysts for each of these stocks, and we know there is serious upside to each of these names.

Online brokers – AMTD, ETFC, SCHW – The online brokers have lagged on interest rate fears. These companies make a significant amount of revenues from the residual cash their customers have in their brokerage accounts. They tend to pay very little interest on their customers’ cash balance, so each increase in interest rates has helped to expand their profitability. With the Fed Funds Futures Market starting to price in potential interest rate cuts, investors have been placing lower valuations on these stocks. If the economy is stronger than the market anticipates and the Federal Reserve only cuts once or twice, we believe the online brokerage stocks are priced attractively.

Asset managers – VCTR, VRTS, BSIG – The asset management industry has had a very disappointing stock performance. Despite the shift from actively managed mutual funds to passively managed ETFs, we think there are opportunities in a few selected assets managers, such as VCTR, VRTS & BSIG, due to their extremely low valuations, strong cash returns, and attractive capital allocation actions.

Life insurance – LNC, PRU – The main reason for lagging performance has been their exposure to lower interest rates. Life insurance companies have large investment portfolios that earn more money when interest rates are higher. Life insurance companies are also capital intensive, and capital intensive companies have been out-of-favor in the current stock market cycle.

Consumer finance – SLM, COF, DFS, NAVI, ALLY, OMF – Consumer finance stocks are at a very interesting point. They are priced as if we were going into a recession. The consumer finance companies have higher returns (Returns on Equity, or “ROE”) and faster growth than the regional banks, but they trade at lower multiples than the regional banks. I understand why they trade at lower multiples: the last recession was a consumer-led recession. Historically, consumer finance companies had weaker liability structures than banks. The banks funded with deposits, whereas the consumer finance companies were funded by the capital markets. This is a weaker liability structure because the capital markets seem to shutdown every 18-24 months, and the funding of consumer finance companies seem to be in question. Now the consumer finance companies have a stronger liability structure as many of them have bank subsidiaries. Credit underwriting is an additional improvement in the structure of consumer finance companies compared to previous cycles. Usually, at this point in the cycle, the consumer finance companies have weakened their credit underwriting in an attempt to gain market share. We haven’t seen a material weakening of credit underwriting this cycle. We think the companies are maintaining their underwriting standards because the previous cycle was so deep and painful that the management teams have learned their lessons. We also think the next recession will not be led by consumers. Before 2008, we had not had a consumer-led recession. Based on the strength of the employment market and consumers’ balance sheets, we don’t see consumers leading the next recession.

European banks – CS, UBS, ING, BCS, LYG, RBS – In our opinion, there is no more hated segment of the stock market than European banks. Negative interest rates and lackluster economic growth in Europe has kept sentiment negative on the European banks for years. If you add the negative narrative that Europe never let their bad banks fail, then you have a recipe for low valuations. What we believe investors are missing on European banks is their capital is well above their target levels, and they are earning returns (ROE) are above 10%. One reason these European banks trade so cheap is the uncertainty around Brexit. The UK based banks such as Barclays, Lloyds, and RBS trade at a valuation that seems very, very cheap. But, nobody can predict how the UK will proceed with Brexit and how the UK economy will act during a Brexit. Another angle to these low valuations is Swiss banks are getting tarred by the European bank brush. The Swiss banks have two advantages over European banks; 1) the Swiss banks are very profitable in their home market, and 2) the Swiss banks have more substantial operations in the US and Asia than their European peers.

Growth banks – WAL, SIVB, EWBC, PACW, CADE, CNOB, SNBY, WTFC, BKU – There are a group of high-growth banks that are trading well below the valuation range they traded for between 2014 and 2018. These banks can generate loans, deposits, or both at high single-digits or low-double digits. They currently trade between 8x and 11x Price-to-Earnings (“P/E”) compared to previously traded P/E which fell between 12x and 23x. We believe there are two main reasons this group is trading at such low valuations:

1) Each of these names are asset-sensitive, which means they would benefit from higher rates. With the Fed Reserve refraining from further interest rate increases and possibly cutting rates, investors have stepped back from owning these stocks, and

2) Some investors believe the organic loan growth at these banks may come from poor underwriting.

After all, it seems like the banks most likely to blow-up during a recessionary cycle were some of the fastest growers in the previous cycle. Maybe one or two, or all of these banks, have potential credit problems. I believe this is an interesting but potential high-risk area to look for opportunity. I don’t think each of these banks will have credit problems, especially given my constructive view of the economy. I am more mixed on the issue of these banks being asset sensitive. On the one hand, I believe any rate cuts will be limited, and organic growth will continue to drive earnings higher. On the other hand, a rate cut will take away some very high margin revenue, and the prospect of a 3% Fed Funds rate seems very distant.

Large regional banks – BAC, WFC, BBT, PNC, FITB – We believe the large regional banks are compelling at this point. They trade at 9x to 10x this year’s earnings, earnings estimates have been increasing despite the flat yield curve, and they are all buying back a lot of stock at prices we think are below intrinsic value. We believe the large regional banks have strong consumer retail franchises. They have developed these franchise over the past 30 years, and switching costs for consumers seem high. Consumers have their routines with their money; they use the same ATMs, they have their online bill payments setup, and they have automatic payments set up in their checking accounts. All of these items raise the bar for consumers to switch banks. Given that the large regionals are not competing for deposits based on price, we believe their consumer franchises are sustainable. On credit, we believe the large regional banks are in a strong position. We don’t believe they have taken excessive risk and are well positioned for a shallow recession.

Even if we are wrong and we get a temporary slowdown in the economy, we believe it will be shallow since the banking system is in such good shape. Bank stock could perform very well in a shallow recession similar to the 2001-2002 recession.

We believe if you are bullish on the economy, the best way to express your view is researching and buying a few of these Financials stocks. Of course, we’re happy to do the investing for you if you’d like to invest in one of our investment portfolios. Send us an email at derek.pilecki@gatorcapital.com or call us at (813) 282-7870.

Our investment thesis in Credit Suisse includes improved capital allocation to higher margin businesses, conservative guidance on future returns, open-ended growth opportunity in wealth management, improved capital levels and potential capital return, improved cost structure, the reduction of legacy costs and litigation leading to improved returns, a low valuation, and the potential benefit of higher interest rates.

Tidjane Thiam was appointed CEO of Credit Suisse in 2015. We admired Thiam in his prior role as CEO of Prudential PLC, the UK based life insurer. We view him as an independent thinker who is willing to make correct but tough decisions that ultimately benefit his companies. Once Thiam arrived at Credit Suisse, he moved to reduce parts of Credit Suisse’s investment bank that were more wholesale in nature such as fixed income, currency, and commodity trading. These parts of the investment bank required a disproportionate amount of capital compared to their risk, did not generate adequate returns, and had no natural cross-sell with private banking clients. Thiam has emphasized Credit Suisse’s private banking and wealth management franchise and the parts of the investment bank that support wealth management such as equity capital markets and credit trading. This reallocation of capital is showing evidence of improved and more consistent results. Ultimately, we believe the new business mix will lead to a higher multiple for Credit Suisse’s valuation.

We like Credit Suisse’s improving returns and believe the bank’s Return on Equity (“ROE”) guidance for 2020 is too conservative. Credit Suisse is improving returns through several efforts:

The bank’s goal is to achieve an 11-12% ROE in 2020, which is up from 4% in 2017. We believe the bank will exceed this target based on the substantial progress it has already made on its cost structure and several high cost debt issues that the bank should be able to refinance. Another source of conservatism is the bank’s guidance which gives no credit for improved returns from the business segments and no credit for potentially higher interest rates.

Credit Suisse has an open-ended growth opportunity in private banking and wealth management. As global income inequality continues to generate more ultra-high net worth people, Credit Suisse is well positioned to service these people. They have a brand and platform to attract assets. Until CEO Thiam arrived in 2015, Credit Suisse was distracted from the wealth management business to some extent and lagged peers in terms of net new assets from clients. Since 2016, Credit Suisse has topped its peers in gathering net new assets from clients. The growth of its wealth management segment is important for Credit Suisse because wealth management is a high return, low-risk business.

Credit Suisse’s ongoing restructuring since 2015 has positioned the bank to return 50% of future earnings to shareholders through buybacks. Credit Suisse has resolved the major pieces of litigation that have been pending since the Great Recession. Credit Suisse has achieved its targeted capital levels and Credit Suisse’s future growth in wealth management will require less capital than past growth in the investment bank. Credit Suisse’s cost structure has declined as well from 21.2 billion Swiss Francs in 2015 to an estimated 17.0 billion Swiss Francs in 2018.

We believe Credit Suisse’s business most closely resembles Morgan Stanley among US-based companies, but since Thiam became CEO in 2015, Credit Suisse’s stock has underperformed Morgan Stanley’s stock. During the first 9 months of his tenure as CEO, the global markets experienced a correction sparked by declining oil prices and issues the high yield market had large amounts of bonds issued by energy companies. During this time, Credit Suisse’s stock performed poorly but in line with Morgan Stanley’s stock. However, during the back-half of 2016, Credit Suisse’s stock did not recover like Morgan Stanley’s for three reasons:

Since the end of 2016, Credit Suisse’s stock has performed in line with Morgan Stanley’s stock, but it has not recovered the significant underperformance of 2016. At the end of September, Credit Suisse’s stock traded for 90% of tangible book value versus Morgan Stanley’s stock which traded at 140% of tangible book value. We believe the stocks of both these companies can trade at 2x tangible book value based on their strong wealth management franchises.

We believe this low valuation is partly attributable to low valuations across all major European banks and partly due to investor concerns around certain business challenges facing Credit Suisse. For at least 15 years, European banks have traded at a discount to US banks. See the chart below from Goldman Sachs research:

Before the Great Recession, US banks traded at an average 48% premium on a Price-to-Tangible Book Value (“PTBV”) basis versus the European banks. During the financial crisis from 2008 to 2011, there were brief periods of time when European banks actually traded at a premium to US banks. Since 2011, as the fiscal problems of countries in the European Union became more widely known, the US banks have again traded at a premium to the European banks. This time the premium is larger at an average of 69%. However, this premium has become even larger during 2018 as European bank shares have underperformed. Today, US banks trade at a 150% premium to European banks. That is, the US bank index (the KBW Bank Index) trades at 2.0x PTBV while the European bank index (the EURO STOXX Banks Index) trades at 0.8x PTBV. We believe this extreme difference in the US bank versus European bank valuations will not persist.

In addition to Credit Suisse’s stock being attractive compared to Morgan Stanley’s on a relative basis, we believe Credit Suisse’s valuation is attractive on an absolute basis. Credit Suisse trades at a valuation of 8.9x 2019 estimated earnings and 90% of tangible book value.

There are three obvious risks present with European banks:

We believe these issues are the main reasons why European banks trade at such extreme discounts to US banks. When looking at the risks in Italy and Turkey, there are several degrees of risks. The primary risk is from operations in the country. A secondary risk is if the bank owns securities issued by the country or denominated in the currency. The tertiary risk is the risk that these countries drag down overall GDP in Europe. Neither Credit Suisse nor UBS has significant operations in Italy or Turkey. In addition, we think the Italian government will ultimately cede to the desires of the European Union.

The prospects of a hard Brexit are more difficult to shrug off because both UBS and Credit Suisse have significant operations in the UK, and the UK is such a large market. We think of Brexit as a Year 2000 type risk. There will be much hand wringing over the prospects of a hard Brexit, but we believe a deal will be made that will not result in the United Kingdom or Europe entering a recession.

One favorable aspect of owning the European bank stocks is the potential benefit from higher interest rates in Europe. As you may know, European interest rates have been negative for several years. The European Central Bank (“ECB”) has kept deposit rates at negative values. The ECB has also had a massive quantitative easing program where they have doubled the size of the ECB’s balance sheet from €2.2 trillion in 2014 to €4.5 trillion in 2017. The majority of the increase has come from bonds issued by various European governments and corporations. As European interest rates rise, banks will generate higher revenues mostly due to earning higher amounts on their large non-interest-bearing deposits and their equity accounts. Goldman Sachs estimates that a 50 bps rise in rates will increase earnings at CS by 12%, UBS by 17%, BCS by 12% and LYG by 9%. Given that European interests rates are so low, we expect any increase in rates to likely be greater than 50 bps.