Capital One stock is interesting because we believe it has the best combination of growth and value among the super-regional banks. With its mix of national lending platforms and online deposit gathering franchises, it is our opinion that Capital One has the best strategic positioning of super-regional banks. The company is posting the best growth rate among the credit card issuers. The non-promotional management team has been positive about the growth opportunities that they currently see. The company’s stock trades for less than 9.0x 2017 Bloomberg’s consensus estimated earnings per share compared with similarly sized banks trading more than 12.0x. Capital One has been returning excess capital to shareholders by repurchasing 6% of outstanding shares per year for the past few years. We think the downside is limited as Capital One trades at 1.2x tangible book value.

We think Capital One is the best positioned of the super-regional banks. Capital One is unique among the super-regional banks in that it has national lending platforms for credit cards and auto finance. These two lending segments have consolidated and peers would have difficulty entering these businesses beyond cross-selling to their existing customers. We believe the growth rates and the returns from these two segments are higher than the typical bank loan portfolio of business loans, commercial real estate loans, and mortgage loans. In late 2015, Capital One added another national lending platform by acquiring General Electric’s Healthcare Finance unit. We give credit to Capital One’s management team for realizing years ago that certain lending businesses would consolidate nationally. Then, they positioned the company to ensure they will be one the long-term players in these markets.

Capital One is also in a better position than its peers with both local and online deposit gathering franchises. Over the last ten years, Capital One improved its liability profile by acquiring banks in New York, Washington, DC, and New Orleans. These banks were primarily acquired for their deposits, but they each had reasonable commercial lending businesses. Capital One has continued to operate these commercial lending businesses in the local markets because they earn more than their cost of capital, but they have lower growth and returns than Capital One’s national lending businesses. In 2012, Capital One enhanced its deposit franchise by acquiring ING Direct, one of the pioneers in online banking. This acquisition gave Capital One the leading position in online deposit gathering. Although the banking system has been awash in deposits since this acquisition, this online deposit gathering scale will enable Capital One to maintain its growth rate when industry deposit growth is less robust. With the combination of national lending platforms, local deposit franchises, and the online deposit gathering presence of ING Direct, we believe Capital One will able to grow faster and earn higher returns than the other super-regional banks.

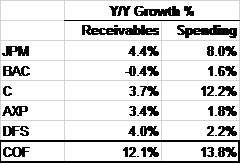

We also think investors are overlooking the best-in-class growth rate of Capital One’s credit card business. The table below shows Capital One is growing both credit card receivables and credit spending by its customers faster than the other major credit card issuers. We believe Capital One’s growth is driven by

As of 6/30/2016

Source: Company reports, Gator Capital Management

Note: C & AXP data have been adjusted for sale of Costco portfolio management’s long-term marketing campaigns focused on rewards and building the best card products with 1.5% cash back (Spark) and double miles cards (Venture). We think Capital One differentiates itself from peers because of a willingness to forgo current earnings for business enhancing investments for customer acquisition or advertising that have a long-term positive net present value. Often, these investments detract from earnings in the current period. An example of this business investment is the 15% annual increase in marketing spending over the past two years, which has accelerated receivable growth from 1% to 12%. However, Capital One’s earnings per share over this time period is flat as the additional revenue from the receivable growth has gone to pay for the marketing spend and to add to its loan loss reserves. While companies in other industries are rewarded for deferring earnings in favor of growth investment, bank investors may be hesitant to give Capital One credit for their growing credit card portfolio until they see evidence of earnings growth. We see this as an opportunity to buy Capital One at an attractive valuation with growth on the horizon.

Capital One’s management has a history of discussing their business in a non-promotional manner, so we take note when we hear them talk enthusiastically about their current prospects. Capital One does not manage earnings or give earnings guidance. Instead, the management team talks in terms of business drivers on earnings conference calls or at investment conferences. When management sees an opportunity to grow the business through additional investment, they will spend the money even if it means they will “miss” the quarter due to the extra expense. On recent conference calls, Capital One’s management has talked favorably about the long-term benefits of the recent growth even though current earnings are not reflecting the recent balance growth of the company’s credit card business.

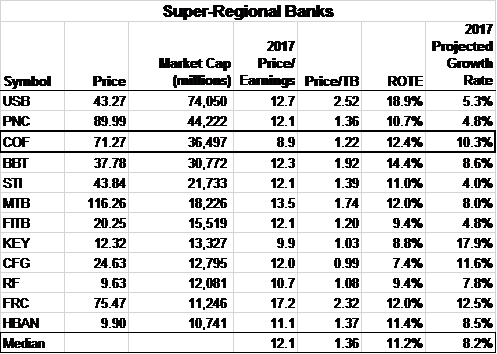

Capital One’s growth is not only compelling versus other credit card lenders, but its valuation is compelling versus other super-regional banks. As you can see from the table, Capital One has the

Source: Bloomberg, Gator Capital

Pricing date: close of September 13, 2016 close lowest valuation of the super-regional banks on a Price-to-Earnings basis. Four banks (FITB, KEY, CFG & RF) have lower Price to Tangible Book Ratios, but each of these banks have lower returns on equity than Capital One.

While we believe Capital One is compelling, we need to acknowledge the bearish arguments against our position:

We think Capital One’s stock is interesting at this time because it has asymmetrical returns. With the stock at $71, we see upside to $126 and downside to $58 by the end 2018. With these targets and dividends, the upside case is +32% annualized return and in the downside scenario the annualized return is -7%.

DISCLOSURE

The ideas expressed in this posting are the views and opinions of the author of this posting (Author). The Author has no obligation to update any of the information contained herein and has no obligation to update the posting to reflect any changes in the Author’s opinion on any of the companies or topics contained herein. Do not rely upon the information contained in this posting for making investment decisions; prepare your own analysis or contact your financial advisor. While the Author has tried to present facts it believes are accurate, the Author makes no representation as to the accuracy or completeness of any information contained in this note. Past performance is not necessarily indicative of future results, and there can be no assurance that targeted or projected returns will be achieved. This is not a recommendation to buy or sell any security discussed herein.